Have you ever wondered how the major stock market indices, such as the Dow Jones Industrial Average or Nasdaq Composite, are calculated? These widely used economic and market performance indicators provide valuable information to investors, businesses, economists, and other professionals. But what is it that affects these indices’ calculations?

This article will explore in detail what goes into calculating each index and look behind the scenes at how financial experts make sense of current market trends. With an understanding of the index calculation process on your side, you can be better informed when making important financial decisions. Join us in uncovering how some of the most extensive stock indexes work.

Overview of Stock Market Indices and What They Represent

The stock market is a complex system that can be challenging for even seasoned investors to manoeuvre. At the centre of this financial cosmos are stock market indices. These indices provide a snapshot of a particular subset of the stock market and can be used to assess the health of a specific industry or the broader economy. In the United States, the most popular indices are the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite.

The Dow Jones Industrial Average consists of 30 large, blue-chip companies, while the S&P 500 tracks the performance of 500 companies across multiple industries. Meanwhile, the Nasdaq is known for its inclusion of technology-based companies. By understanding the nuances of each index, investors can better determine where to put their money and assess the market’s general direction. Learn with ADSS what indices are in detail and how economic data is used to make sense of a constantly changing market.

How to Calculate the Stock Market’s Overall Performance

Calculating the performance of a stock market index is more complicated than adding up the numbers of all the stocks in that index. Several factors and steps are involved in this process, including market capitalisation, weighting, and price changes. Market capitalisation is a crucial component in calculating stock market indices. It refers to the total value of all the company’s shares that comprise an index. Companies with a higher market capitalisation have more weight in calculating an index than those with lower market caps.

Meanwhile, weighting is another crucial factor determining how each stock’s performance affects the overall index. Different indices use different methods of weighting, such as price-weighted or market-cap-weighted. For example, the Dow Jones Industrial Average is a price-weighted index, meaning that companies with higher stock prices influence the index’s performance more.

Lastly, changes in stock prices also play a significant role in calculating an index’s performance. Fluctuations in individual stock prices can heavily impact the overall performance of an index. Thus, it is essential to consider the percentage changes and the market capitalisation and weightings.

Examining the Components of a Stock Market Index

Each stock market index comprises different components, which can vary based on the index’s purpose and methodology. These components are generally selected based on specific criteria such as company size, industry, and liquidity. The goal is to create a representative sample of stocks that accurately reflects a particular market segment’s performance.

For example, the S&P 500 uses a market capitalisation criterion, while the Nasdaq Composite focuses on technology-based companies. Each index also has its own set of rules and regulations for component selection. These rules may change over time to adapt to the evolving market conditions.

Different Weighting Systems Used in Calculating Indices

One commonly used method is market-cap weighting, where companies with larger market capitalisations have a higher weight in the index. This approach is often seen in broad-based indices such as the S&P 500 and the Nasdaq Composite. Another method is price weighting, where stocks with higher prices significantly influence the index’s performance. This approach is used by the Dow Jones Industrial Average, which only includes 30 companies.

Other less common weightings, such as equal-weighted indices, where all components are given the same weight regardless of their market capitalisations or prices. Each type of weighting system has advantages and disadvantages, and investors should consider these factors when evaluating the performance of an index.

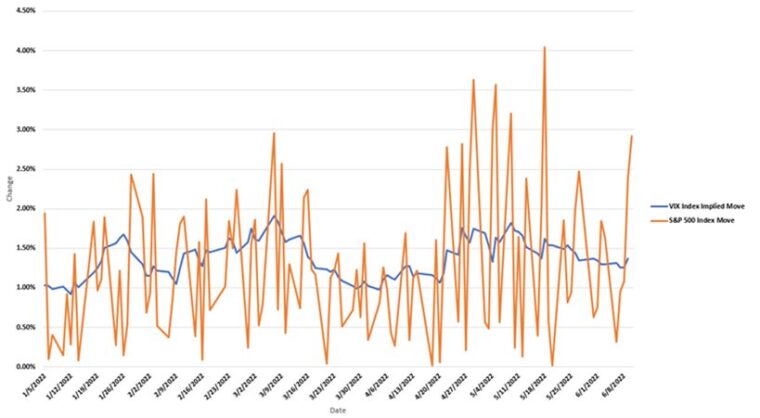

Understanding How Volatility Affects an Index’s Value

Volatility refers to the frequency and extent of price fluctuations in the stock market. It measures how much a stock’s price moves up or down over a certain period. Volatility can significantly impact an index’s value, as it reflects the overall performance of the stocks within that index.

High volatility can lead to sharp increases or decreases in an index’s value, indicating a more unstable market. Conversely, low volatility can mean a stable market with less dramatic price movements. Understanding an index’s volatility is crucial for investors as it can help assess the level of risk associated with investing in that particular index.